CoreLogic continually monitors changing market conditions throughout the U.S. and Canada and makes appropriate adjustments for these situations when necessary. This is the price to construct or replace an entire building of equal quality and utility, using current prices for labor, materials, overhead, profit, and fees at the time of the appraisal. Market value is the estimated price at turbotax live 2020 which a property would be sold on the open market between a willing buyer and seller under all conditions for a fair sale. Replacement cost is the estimated cost to construct, at current prices, a property worth the amount of the property being appraised. In this situation, it would cost the company $23,000 to purchase a similar asset to the one they current have in order to replace it.

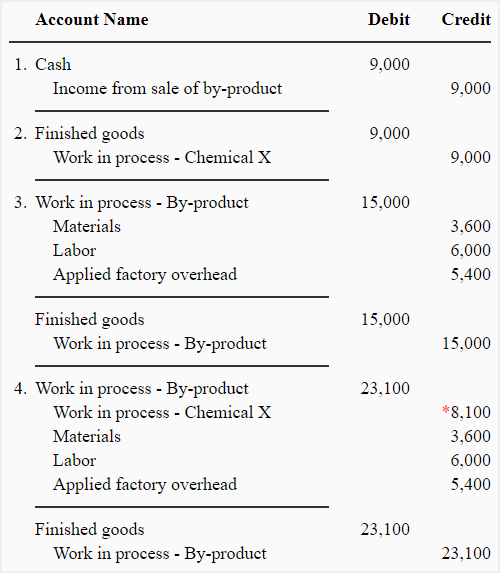

Journals

Thus, $23,000 is the replacement cost of the $20,000 truck because this is how much it would cost to buy that same truck today. The company should make a wise decision by carefully calculating this cost by comparing its repair and maintenance costs, which can be levied over the years if the asset is not replaced. A business then considers the cash outflow for the purchase and the cash inflows generated based on the increased productivity of using a new and more productive asset. The cash inflows and outflow are adjusted to present value using the discount rate, and if the net total of all present values is a positive amount, the company makes the purchase.

Cost Approach

This method is not helpful for those businesses where the current market price is not available. The insurance company uses this type of technique to find out the replacement cost of the asset, which is considered. The policy is designed so that the policyholder gets some benefit from the insurance companies. Still, sometimes the settlement of the claims is done with a lesser amount than the asset’s actual value.

What is the approximate value of your cash savings and other investments?

- Market value is the estimated price at which a property would be sold on the open market between a willing buyer and seller under all conditions for a fair sale.

- Actual cash value refers to the monetary value of the property, measured as replacement cost minus depreciation.

- Cpp suffers from the problem that it does not consider the individual price index related to the particular assets of a company.

- The cost approach indicates an intangible asset’s value by considering its replacement or reproduction cost, relying on the economic premise that a prudent investor would pay no more for an asset than the cost to acquire an asset of equal utility.

It represents the amount of money required to acquire a substitute asset that would provide the same utility or functionality as the original asset. Replacement cost is often used in financial valuation to assess the value of assets, especially in industries where asset replacement is common or necessary for business operations. While the cost approach is popular for its ease of application, its largest drawback is the subjectivity related to input parameters that are chosen—particularly with respect to obsolescence. With regard to the reproduction cost method, it fails to reflect the actual market demand for the asset and hence neglects the possibility that a third party might not want an identical replica on the valuation date. Furthermore, opportunity costs are often insufficiently reflected in the cost base.

Do you own a business?

It is also vital for a company to correctly calculate the depreciation since it will have a significant impact on the decision to continue the old asset or replace it with a new one. Sometimes it becomes a challenge to estimate the correct market value of the asset, and hence it may lead to making wrong decisions by the organization. The main limitation with replacement Cost Accounting is that it only works well under certain circumstances, such as when there has been no capital gains tax and indexation has not played a part in any real property investment decisions. It is also important to note that replacement Cost Accounting should not be used for intangible assets. Rca requires the appropriate index numbers to be used when replacing old assets, which means it does not result in any loss. By using rca instead of cpp you make provisions based on the current costs the company will incur after years of use for an asset compared to the original cost of that asset.

To read this content please select one of the options below:

This does not include value lost to depreciation, or changes in the market value of that property due to fluctuations in supply and demand. The supply and demand for housing also impacts the fair market value, just as the supply and demand for labor and materials affect replacement cost. When situations arise where supply does not match or equal demand, market value and the replacement cost can change quickly.

When a company is evaluating the scenario of replacing an asset it is very important to consider the profitability of the purchase at the new cost. Since the newly purchased asset might be more expensive than the old asset, the new purchase must be evaluated carefully to see if the net present value of the investment stays positive considering the new price of the asset. After conducting market research, ABC Inc. determines that similar trucks with the same specifications and features are currently priced at $60,000 each in the market. Therefore, the replacement cost of each truck is $60,000, reflecting the amount ABC Inc. would need to spend to acquire a new truck with similar capabilities. The insurance company’s primary function is to evaluate whether the decision of replacement is better than repair and maintenance.

If a company’s asset has a historical cost that differs widely from its current market price, the replacement cost might increase the value of the company. For instance, if the company purchased a building 20 years ago in an up-and-coming area, the historical cost of the building is much less than its replacement cost. Replacement Cost refers to the cost of replacing an asset with an identical or similar asset at its current market price.

Book of Ra Soluciona alrededor legendario tragamonedas de balde

Genius away from Ounce Slot for people Participants

Try Added bonus Poker fifty Hand by Habanero Free Trial & Large Wins Wait for Center Gambling establishment

Категорії новин

Категорії товарів

News categories

Product Categories

(095) 222 04 06 - служба доставки 1100 – 2200

Замовлення приймається до 2:30