Work opportunities for a financial accountant can be found in both the public and private sectors. A financial accountant’s duties may differ from those of an accountant who works for many clients preparing their accounts, tax returns, and possibly auditing other companies. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Great! The Financial Professional Will Get Back To You Soon.

Even though the charges relate to services incurred in July, the cash method of financial accounting requires expenses to be recorded when they are paid, not when they occur. An income statement can be useful to management, but managerial accounting gives a company better insight into production and pricing strategies compared with financial accounting. An income statement, also known as a “profit and loss statement,” reports a company’s operating activity during a specific period of time.

Is there any other context you can provide?

Understanding how tools like AI and cloud-based software streamline workflows and reduce errors reflects adaptability and integration into traditional practices. During high-pressure financial reporting periods, prioritizing tasks effectively showcases organizational skills and the ability to manage stress while maintaining quality. This involves strategic thinking and adaptability, balancing competing priorities without compromising financial integrity. In this example, the General Fund paid and recorded as an expenditure all of an invoice that included a portion that pertained to another fund. The Enterprise Fund should record an increase in expense at the time the reimbursement is made.

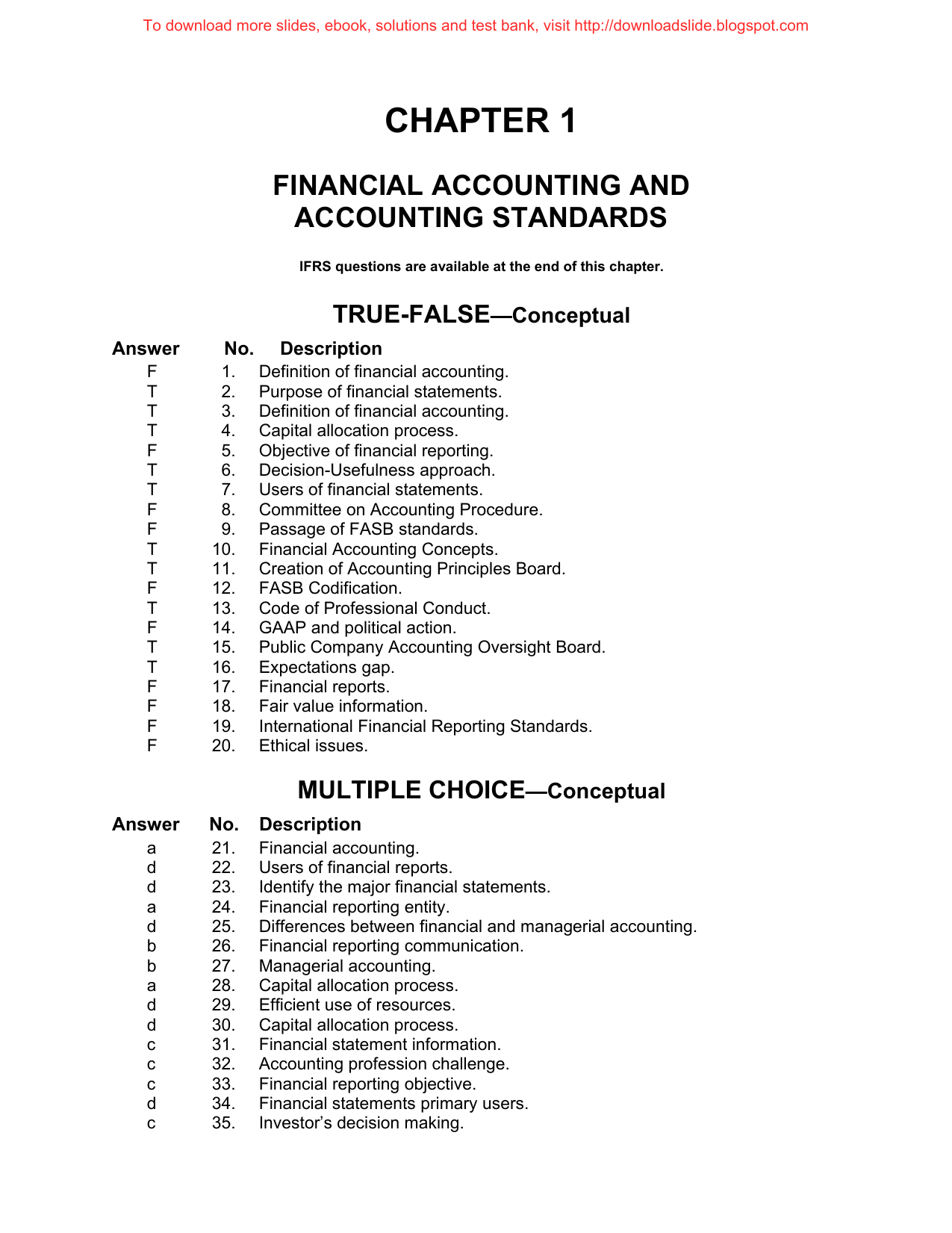

Accounting and Finance MCQs Test 1

Factors that should be considered when making decisions include the company’s financial position, Cash Flow, profitability, and business strategy. Accountants use the information to make decisions by analyzing data and trends to make informed decisions to help the company achieve its goals. When preparing for an accountant interview, it’s important to understand that the states with no income tax role of an accountant can vary widely depending on the industry and the specific needs of the organization. Accountants are essential for maintaining financial integrity, ensuring compliance with regulations, and providing insights that drive business decisions. The end result is a financial report that communicates the amount of revenue recognized in a given period.

Evaluating the financial health of an investment opportunity requires analyzing financial metrics and market conditions. Synthesizing complex data to draw informed conclusions impacts strategic decisions, revealing an approach to risk assessment and potential opportunities. Budget forecasting requires analytical skills, strategic thinking, and an understanding of financial landscapes. Integrating data points, anticipating trends, and aligning forecasts with organizational goals are key. This process involves synthesizing complex data into actionable insights, guiding decision-making and resource allocation.

From tackling questions about your experience with financial software to discussing how you handle tight deadlines, we’ve got you covered. Ace your accountant interview with insights on key financial concepts, problem-solving strategies, and communication techniques for career success. For example, the current ratio compares the amount of current assets with current liabilities to determine how likely a company is going to be able to meet short-term debt obligations. The accounting principles used depend on the business’s regulatory and reporting requirements. Companies and organizations often have an accounting manual that details the pertinent accounting rules.

Managerial accounting assesses financial performance and hopes to drive smarter decision-making through internal reports that analyze operations. Financial accounting is dictated by five general, overarching principles that guide companies in how to prepare their financial statements. A shareholders’ equity statement reports how a company’s equity changes from one period to another, as opposed to a balance sheet, which is a snapshot of equity at a single point in time. A balance sheet is used by management, lenders, and investors to assess the liquidity and solvency of a company. Through financial ratio analysis, financial accounting allows these parties to compare one balance sheet account with another. Accuracy in accounting is essential, as errors can lead to significant discrepancies and compliance issues.

- Handling transitions involves data migration, user training, and troubleshooting, maintaining accuracy and compliance.

- Bridging the gap between financial concepts and strategic goals requires technical proficiency and the ability to tell a compelling story with data.

- In the other example, the utility expense would have been recorded in August (the period when the invoice was paid).

- Financial accounting guidance dictates when transactions are to be recorded, though there is often little to no flexibility in the amount of cash to be reported per transaction.

- Cost reduction strategies balance fiscal responsibility with quality assurance, supporting sustainable growth.

Financial accounting is a specific branch of accounting involving a process of recording, summarizing, and reporting the myriad of transactions resulting from business operations over a period of time. Maintaining an accurate general ledger is fundamental to financial reporting integrity. It serves as the central repository of transactions, supporting compliance, strategic planning, and identifying discrepancies. Financial accounting is intended to provide financial information on a company’s operating performance.

Finest Online Pokies the real deal bejeweled 2 slot machines Cash in 2024 for Aussie Professionals

Defeat Bots Position: Finest Totally free Incentives Offers

1001 book of pharaon hd Slot Free Spins Spartacus 150 Kostenlose Spins Bewertungen Spiele

Категорії новин

Категорії товарів

News categories

Product Categories

(095) 222 04 06 - служба доставки 1100 – 2200

Замовлення приймається до 2:30