If you choose to compare your accounts receivable turnover ratio to other companies, look for companies in your industry with similar business models. There’s no ideal ratio that applies to every business in every industry. Norms that exist for receivables turnover ratios are industry-based, and any business you want to compare should have a similar structure to your own. The receivables turnover ratio shows us that Alpha Lumber collected its receivables 11.43 times during 2021.

Book a demo with our friendly team of experts

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

High vs. Low Account Receivables

Its primary purpose is to measure how efficiently your company collects cash. You can calculate this ratio using data from your financial statements. The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance.

Receivable Turnover Ratio

- Using online payment platforms like Square or Paypal allows businesses to remove the need for collections calls and potential losses due to non-payments.

- First, you’ll need to find your net credit sales or all the sales customers made on credit.

- To calculate the A/R turnover, you first need to find the average A/R balance.

- Additionally, you will learn what does a high or low turnover ratio mean, and what are the consequences of each.

If clients have mentioned struggling with or disliking your payment system, it may be time to add another payment option. As we previously noted, average accounts receivable is equal to the first plus the last month (or quarter) of the time period you’re focused on, divided by 2. Credit policies that are too liberal frequently bring in too many businesses that are unstable and lack creditworthiness. If you never know if or when you’re going to get paid for your work, it can create serious cash flow problems. We calculate the average accounts receivable by dividing the sum of a specific timeframe’s beginning and ending receivables (most frequently months or quarters) and dividing by two. You can find the numbers you need to plug into the formula on your annual income statement or balance sheet.

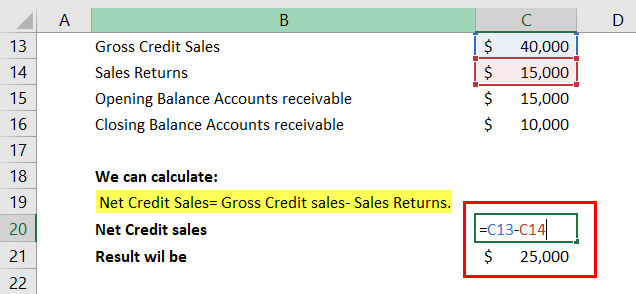

Now that we have understood its importance, here are a few tips for businesses to tap in order to increase the receivable turnover ratio. In the fiscal year ending December 31, 2020, the shop recorded gross credit sales of $10,000 and returns amounting to $500. Beginning and ending accounts receivable for the same year were $3,000 and $1,000, respectively. Use the Accounts Receivables Turnover Ratio Calculator to calculate the the quality of receivables and credit sales, the higher the Turnover Ratio, the better the collection frequency of credit sales.

The accounts receivable turnover ratio serves as a convenient tool for promptly assessing collection efficiency, but it does possess certain limitations. However, the asset turnover ratio looks at the overall asset picture and includes cash reserves, inventory, and fixed assets such as property, equipment (PPE,) etc. You must compare your AR turnover ratio to similar company ratios in your sector. Consider factors such as working capital structure, percentage of credit sales, and payment terms when comparing ratios. For example, if a customer’s payment period has steadily increased, the AR turnover ratio will not reveal the problem.

This legal claim that the customers will pay for the product, is called accounts receivables, and related factor describing its efficiency is called the receivables turnover ratio. The accounts receivables turnover ratio is also known as the receivables turnover ratio, or just the turnover ratio for shortness. Accounts receivable turnover ratio is calculated by dividing your net credit sales by your average accounts receivable. The ratio is used to measure how effective a company is at extending credits and collecting debts. Generally, the higher the accounts receivable turnover ratio, the more efficient your business is at collecting credit from your customers.

When making comparisons, it’s ideal to look at businesses that have similar business models. Once again, the results can be skewed if there are glaring differences between the companies being compared. That’s xero order management because companies of different sizes often have very different capital structures, which can greatly influence turnover calculations, and the same is often true of companies in different industries.

Your accounts receivable turnover ratio measures your company’s ability to issue a credit to customers and collect funds on time. Tracking this ratio can help you determine if you need to improve your credit policies or collection processes. Additionally, when you know how quickly, on average, customers are paying their debts, you can more accurately predict cash flow trends. And if you apply for a small business loan, your lender may ask to see your accounts receivable turnover ratio to determine if you qualify. Your accounts receivable turnover ratio measures your company’s ability to issue credit to customers and collect funds on time. Tracking this ratio can help you determine if you need to improve your credit policies or collection procedures.

While the receivables turnover ratio can be handy, it has its limitations like any other measurement. Since we already have our net credit sales ($400,000), we can skip straight to the second step—identifying the average accounts receivable. A low ratio may also indicate that your business has subpar collection processes.

Cafe Gambling enterprise Opinion: Appealing Games, Secure Enjoy, and you will Stellar take5 bonus Bonuses

Darmowe automaty do rozrywki z brakiem zapisu przez internet

Enjoy Christmas Provide play tres amigos slot online no download Hurry free of charge Festive Position Game

Категорії новин

Категорії товарів

News categories

Product Categories

(095) 222 04 06 - служба доставки 1100 – 2200

Замовлення приймається до 2:30